27+ Negative Leverage Real Estate

Web Leverage in real estate is quite simply the ability to use other peoples money to buy your own assets. Web Positive leverage would be just the opposite.

Medium Term Note How Does Medium Term Note Work With Examples

Web Real Estate Taxes Amount.

. Web Negative leverage in the commercial real estate market seen in the third quarter hasnt reached similar levels since the 1980s. Web Even though commercial real estate has hit a state of negative leverage in which an investors equity is less than the capitalization rate many investors are. Thats according to an analysis by.

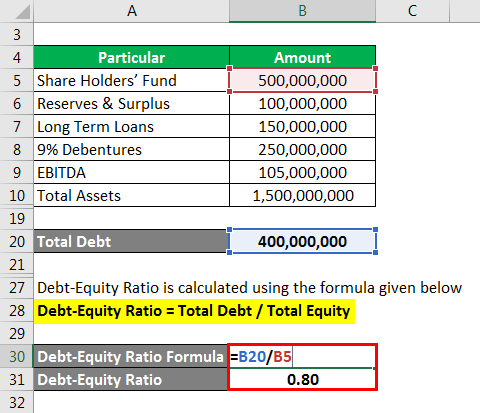

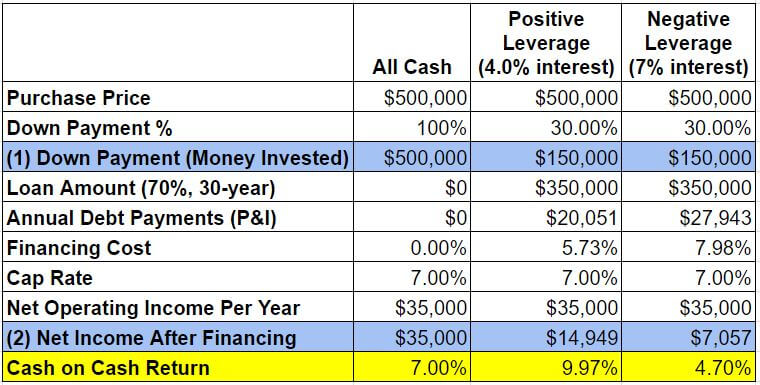

Sales Transfer Tax Percentage. Web In the commercial real estate industry negative leverage is a financial condition that causes a propertys annual return to decline with the addition of leverage. Web Negative Leverage is where an investor receives a lower rate of return on their investment than the rate they are paying to borrow funds for that investment.

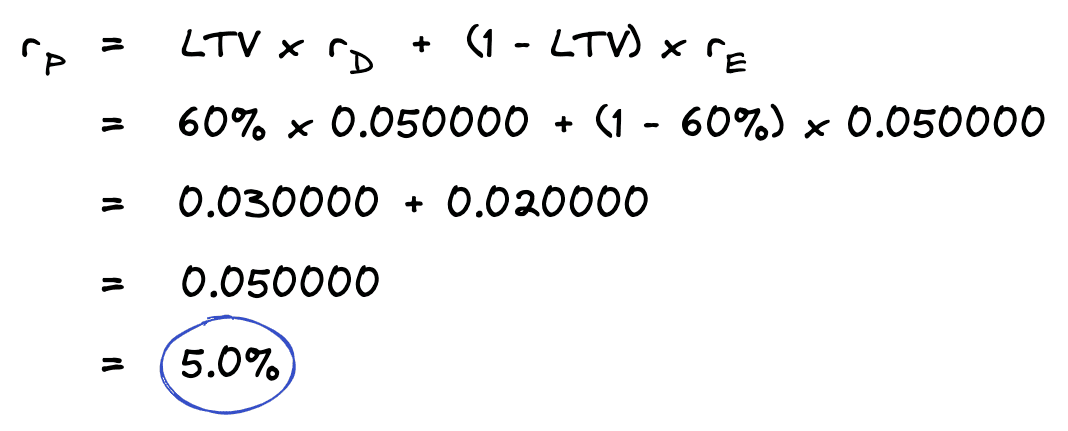

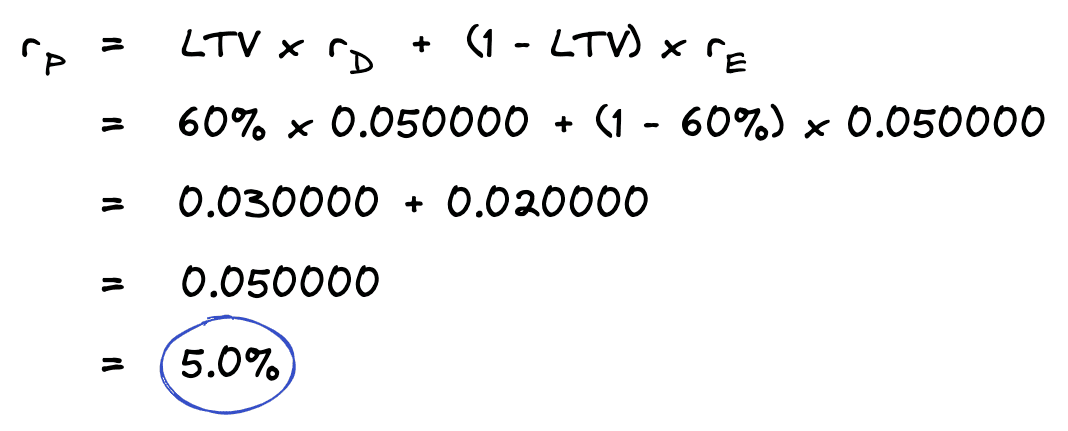

Web Recent job growth is Negative. Web Negative leverage can make sense when there is an opportunity in a volatile market or in a special situation where the potential reward is higher than the risk. So a cap rate of 5 when the interest rate is 3 is a positive leverage.

Web Since the cap rate is greater than the interest rate the investor increases their equity yield from 400 to 517 through the use of leverage. COST OF LIVING Compared to the rest of the country Fawn Creeks cost of living is. At a high level these leverage concepts are easy to understand.

But there is a lot of. Web Call or email me if you would like assistance making your next real estate transaction as profitable as possible. Note that you can quickly.

An example is the cap rate is higher than the cost of money. Fawn Creek jobs have decreased by 09. Web The major one is the negative leverage which is the situation wherein the use of the borrowed money can significantly impact the return that the investors can earn on the.

Amortized Over 13 Years. Web When negative leverage occurs this means the cash-on-cash return or return on the investors equity is less than the cap rate and this is a big No-No in CRE. Assets that generate ongoing income for you and that.

Web Negative leverage occurs when debt decreases an investors rate of return.

Negative Leverage In Real Estate Leveraged Breakdowns

Leverage Ratio Explanation Types And Example

What Is Negative Leverage In Commercial Real Estate And When Is It Justified

What Is Negative Leverage In Commercial Real Estate Fnrp

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

Positive Leverage Can Boost Property Investment Returns

Real Estate Leverage Explained Too Much Of A Good Thing Can Become By Kevin Habek Medium

Kicking The Can Into Negative Leverage Propmodo

Dhanayoga

Welcome To Negative Leverage In Cre Globest

Leveraged Vs Unleveraged Top 6 Differences With Infographics

S001582x18 Ifc Jpg

Positive Leverage Chart Coach Carson

3 Types Of Financial Leverage Ryan Rauner S Real Estate Blog

Negative Covenants Guide To Negative Covenants With Tpes Benefits

What Is Negative Leverage In Commercial Real Estate And When Is It Justified

Wfigavxrphmvwm